Creating Conscious Wealth:

The Art of Blending Purpose With Prosperity to Create Lifelong Abundance

AN INTERVIEW WITH SETH STREETER, MS, CFP, CEA, CDFA

true abundance comes as a result of tuning into your purpose and focusing on the 11 dimensions of wealth. photo: lerina winter

true abundance comes as a result of tuning into your purpose and focusing on the 11 dimensions of wealth. photo: lerina winter

In the following interview we sat down with Seth Streeter, one of the most inspiring, knowledgeable, and brilliant people we know, to get his take on holistic success, conscious wealth, and the trends shaping the emerging Financial Revolution. Seth has over 25 years in the financial industry, is the CEO and founder of Mission Wealth, a conscious wealth management firm managing $5 billion in assets for over 2100 families and non-profits. Seth holds a Masters of Science in Financial Planning and is widely renowned throughout the financial industry and entrepreneurial community as a thought-leader in the area of conscious financial planning.

In addition to helping hundreds of individuals and families to redefine wealth beyond finances, he remains active with environmental and entrepreneurial organizations in his local community of Santa Barbara, California where he lives with his two children. In 2017, Seth founded SustainableFuture.org, a nonprofit designed to unite the community to address serious climate change concerns. The technology platform utilizes gamification to amplify existing nonprofit, business, schools and public programs that empower positive actions.

Seth has been an active member of YPO (Young President’s Organization), serving in various capacities, including as the Global Chair for the Financial Services Network with over 2,000 executive members, as the founder of the Inspired Living Subnetwork and as a board member for the Health and Wellness Network with over 6,500 global members. In 2017 he spoke at the organization’s Global Leadership Conference in Vancouver and has since become a keynote speaker and facilitator, including the award-winning “Develop your 3.0 Vision for Life” international retreats that he leads. In 2016 he graced the TEDx stage and delivered his first Tedx talk, which you can watch below.

Conscious Lifestyle Magazine: Please define Conscious Wealth and give us an outline of what it means and what’s involved in it, so that anybody walking into this conversation can wrap their head around what we’re talking about.

Seth Streeter: Wealth traditionally has been about money—it’s been about material accumulation, it’s been about your 401K plan, it’s been about the home you purchase—it’s how much money is in the bank account.

Conscious Wealth is when we step beyond that definition and look at our lives much more holistically and factor in different components, such as our health, our relationships, our career satisfaction, the amount of impact we’re having in the community and in the world, to our intellectual growth, to our spiritual capital, to our emotional wellbeing. These broader definitions are what I’m really calling Conscious Wealth. Because someone could be worth $50 million, but if they can’t climb two flights of steps without being winded because they’re so out of shape, and they go home a stranger to their family because they’re working all the time, and they need sleeping pills to sleep at night because they have so much anxiety, are they truly wealthy just because they’re worth $50 million? So, Conscious Wealth looks at the broader picture of what wealth truly should be.

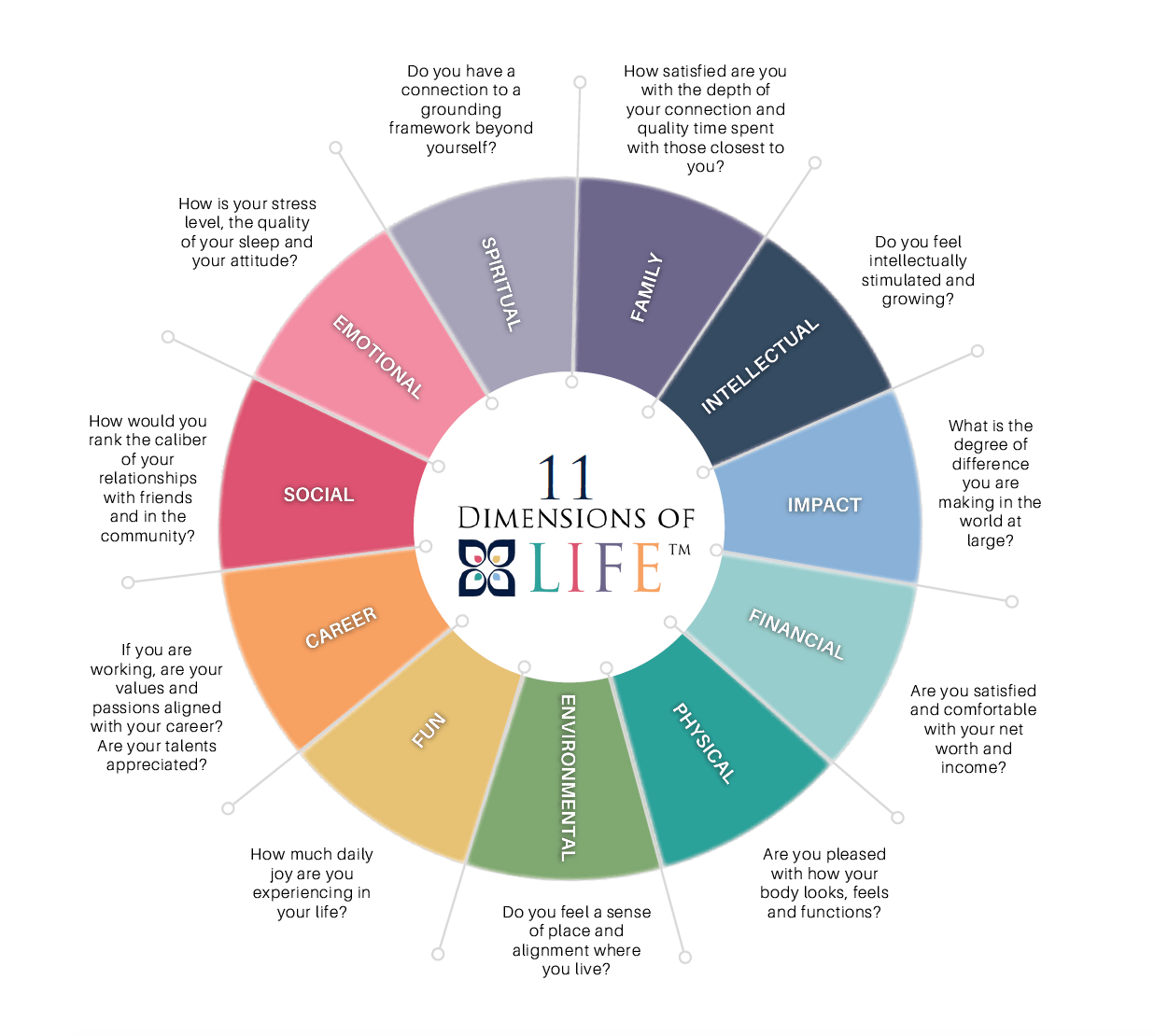

CLM: Beautiful. So, let’s dive into some more of these different aspects. Can you define the Ten Dimensions of Wealth and Holistic Success?

SS: The one that everyone knows about is the financial dimension. Do you have enough to live your life? Wealth is living within your means. So, as long as you have enough to live the life you want to live, well, then you’re wealthy.

The next component of wealth is impact. Do you feel like you’re really leveraging your talents and gifts in the world and making a difference? It could be in a small way, volunteering with one child at a school, or pet-sitting. Or, it could be in a really large way in which you want to impact the environmental issues we’re facing today or global illiteracy. So, impact is an important dimension of wealth because we know the more we give, the more we get.

Emotional wealth has to do with your attitudes and wellbeing. Do you wake up happy? Are your stress levels low?

The social and family dimensions have to do with our intimate relationships—both our family and friends, as well as our relationships in the community.

The amount of fun we have is about whether you are living your bliss? Do you have big belly laughs? Are you having enough fun in your life? A lot of people are really actually lacking in that wealth factor.

Your physical wealth has to do with how your body looks, feels, and functions. Is it able to do what you want it to do without pain or injury?

The environmental dimension is about feeling a sense of place with where you live. It could be the geographic location and the feeling you have within your home. Are your lifestyle preferences optimized there, such as the climate and access to nature or a city, and does it feel like you?

Spiritual wealth is your connection to a framework beyond the everyday, something that anchors and centers you.

Intellectual wealth is whether you’re feeling stimulated. Do you feel like you’re growing intellectually or do you feel kind of stagnant?

Your career wealth has to do with whether you feel you’re being appreciated for your talents and contributions and do you feel aligned with a mission beyond yourself with your employer.

The 11 dimensions of wealth.

The 11 dimensions of wealth.

CLM: Definitely. So how did the Ten Dimensions of Wealth come together for you? How does it relate to your experience and your background?

SS: First, professionally, I’ve been in finance for 25 years, and I’ve been an advisor to hundreds of families, mostly on the dimension of financial wealth, and then I realized firsthand how financial wealth really wasn’t the sole source of happiness for these people, or the sole source of frustration in some cases. So, it was from my own professional experience of having thousands of appointments over the last 25 years, and seeing, wow, there’s more to this than money and then starting to put that into practice in my professional life.

From a personal standpoint, I’ve lived this myself. I was someone who was raised within a very goal-driven family. My brother and I had high expectations on us to do well academically, do well in sports, be involved in student government, and we always had jobs. So, I executed that strategy diligently, thinking that was going to get me ahead. It got me to a point where I realized that, even though I was achieving a lot of success in a traditional sense, I was really not fulfilled, and I was longing for more. So, from a personal standpoint, I realized that there was more to success than these achievements, these traditional metrics of career and finance and looking good on paper with all A’s. I knew that I was longing for something deeper and more fulfilling. So, I think it was kind of a bridge of those two—my professional life and my personal life—that led me to where I am today.

CLM: Of the Ten Dimensions, which are the ones that you see people struggling with the most?

SS: I would say it all starts with the self. Most people are so focused outside of themselves—and I’ll say financial, of the ten, is the one that hits on that the most. Because most people are thinking that once they get that job promotion, once they make more money, once their 401K balance goes up, once they can buy their first home, once they pay off their school debt… well, then finally they can be happy! So, it starts from a finance standpoint because people might actually attain those milestones—they might get the job, get the new car, get the promotion—and then realize they’re never satisfied because that benchmark always gets raised to another level. This goes for people I know who are worth $20 million who are not satisfied because their neighbor has $30 million, and then that person knows someone who has $50 million. And you’re never there when you’re looking for these external benchmarks to then trigger internal happiness; it doesn’t work that way.

So, I would say once someone realizes that that’s fools’ gold, that pursuit of the external, it really gets into the personal. Really, it’s a blend. The spiritual is a big part of it; the physical too—if you don’t feel good it’s hard to perform in life. Your social structure matters, specifically because the people you are around all the time shapes the person you are, so if you’re around people who are solely focused on “greed is good” and capitalism in the traditional sense, then you are going to think that is what you need to be pursuing. So, oftentimes, re-shifting a social structure really helps someone find more of that personal balance. Emotional wellbeing is critical; there are so many people who are so stressed and beating themselves up to try to get ahead—fighting traffic, battling hundreds of emails, doing the dance everyday—thinking that once they finish those emails at midnight and once they get ten appointments in a week, then, finally, I’ll be good enough.

All of these other nine dimensions besides finance blend together because it comes down to realizing that your sense of worthiness isn’t tied to any type of performance. There’s nothing you can achieve or acquire that will allow someone to actually feel worthy. Once someone gets that eye-opener, that translates across the board—in their careers, relationships, health and their emotional wellbeing, and in the impact they’ll ultimately be able to have in the world.

CLM: How do you see peoples’ lives shift once they make that connection to the deeper aspects of Conscious Wealth? That is, once they understand that they are being psychologically driven by these unconscious things, that aren’t necessarily in alignment with their life purpose, and let them go, what happens?SS: Oh, man! It’s really exciting! It’s incremental and sometimes it’s exponential. When someone has the AHA!–which really comes from hitting a pause button in their life and actually asking: “Am I happy or do I need to redirect my energies and focus elsewhere?” Once they make that shift, then all of a sudden, I’ve seen that things really start to fall in line. People might make major career changes and then their stress levels go down. As their stress levels go down, their health improves. As their health improves and their stress goes down, they have more family time and balance, their relationships improve. As they have more time and balance, they begin to think about ways in which they can give back, which they didn’t have time for before. There is an absolute domino effect between all these other nine dimensions that all seem to conspire in someone’s favor toward justifying and validating the decision to step away from that prior path and into what’s truly in alignment with their highest goals.

CLM: I love that, and let me play devil’s advocate for a little bit. What would you say to people who have this idea that they can’t do these things, that they can’t play more because they have bills to pay or responsibilities or a family? Because what you’re essentially saying is, follow your bliss on a certain level. Do the things that really bring you joy and happiness first. How do you do that and still create wealth in your life and still deal with responsibility?

SS: Like with Maslow’s Hierarchy of Needs, there is a certain baseline of financial practicality that needs to be adhered to. I am not advising people to just leave all responsibility and be whimsical—not pay your mortgage bill and forget your credit card bill and stop funding your kids’ college and just go join the circus! I help them make sure that their blocking and tackling of their baseline finances are in good order. That’s why financial planning is a great portal into these conversations. Because once someone has a basic understanding of cash flow, assets and liabilities, taxes, estate planning—which are kind of the baseline four—then we can start moving up that Maslow pyramid to start working toward areas of self-actualization.

There’s a study that was done in 2010 by a couple of professors at Princeton that actually had a sample of 450,000 people that they studied over two years, and it was about the correlation between income levels and happiness. What they found was that there was a positive correlation between these peoples’ happiness and income levels up to $75,000 a year of income; beyond $75,000 a year of income, there wasn’t that much of a correlation at all with happiness levels. Typically, I’m dealing with more affluent people who are above that baseline threshold—they know that they’re going to be able to pay their rent or pay their mortgage that month—and they’re stressing out in a zone where it’s not about turning the lights on; it’s about them stressing over stuff they shouldn’t have to be stressing about. But, yes, there should be a baseline level of practicality we have with our finances; and, in doing so, it’s going to free you up to pursue your bliss in a sustainable way versus just over two months until your credit cards are capped and you have to go face reality again.

CLM: As you were talking about this, it came to me that this idea that it’s not spiritual to focus on money, that money is just a distraction from the spiritual path, this is something that comes up a lot, even though one of the Ten Dimensions of Wealth is spiritual. Can you talk to how having a healthy relationship with money can actually be in support of your spiritual path and the spiritual dimension of love? How can we include money on the spiritual path, because it’s so necessary in our day-to-day lives?

SS: Money has no value in and of itself; it’s just a representation of its value elsewhere. A dollar is just a piece of paper of paper that’s worth about four cents. A credit card is just a piece of plastic that’s worth about one cent. Gold bullion is just gold that we put a monetary value to. When we think about value, value is really energy. With money, we’re putting a lot of value, a lot of energy, into something that really doesn’t have power: a piece of paper, a piece of plastic. Instead, the spiritual integration with money is more about how that energy can flow through you into the world and make a positive difference and help others. The spiritual framework around money is really about creating value by being of service to others.

And, when you are leveraging your gifts and being of service to others in your own unique way, then money will be a by-product of that, rather than saying: “I need to make as much money as possible and what careers will pay me the most money?” I’ve counseled a lot of young people over the years and eventually with this type of thinking they will burn out because they’re not being fueled from an authentic place. So, really, the spiritual connection to money is about authenticity, it’s about service to others, it’s about recognizing that your job is to be in full expression of your gifts into the world; and, if you do that, money will be a by-product.

CLM: In that same vein of thinking, is worthiness, which you mentioned earlier, a by product as well?

SS: First of all, for me, spirituality is an inside job; and I’ve learned that worthiness is an inside job as well. Spirituality, for me, doesn’t come from doing a bunch of things out there; and worthiness, I’ve learned the hard way, doesn’t come from retaining a bunch of things out there. All three—spirituality, worthiness and wealth—all three are inside jobs, so in that way, they’re completely connected.

CLM: So how does this tie in to life purpose? A lot of people make their money just being driven by wealth. But, after a certain point, after you make enough money, then what?

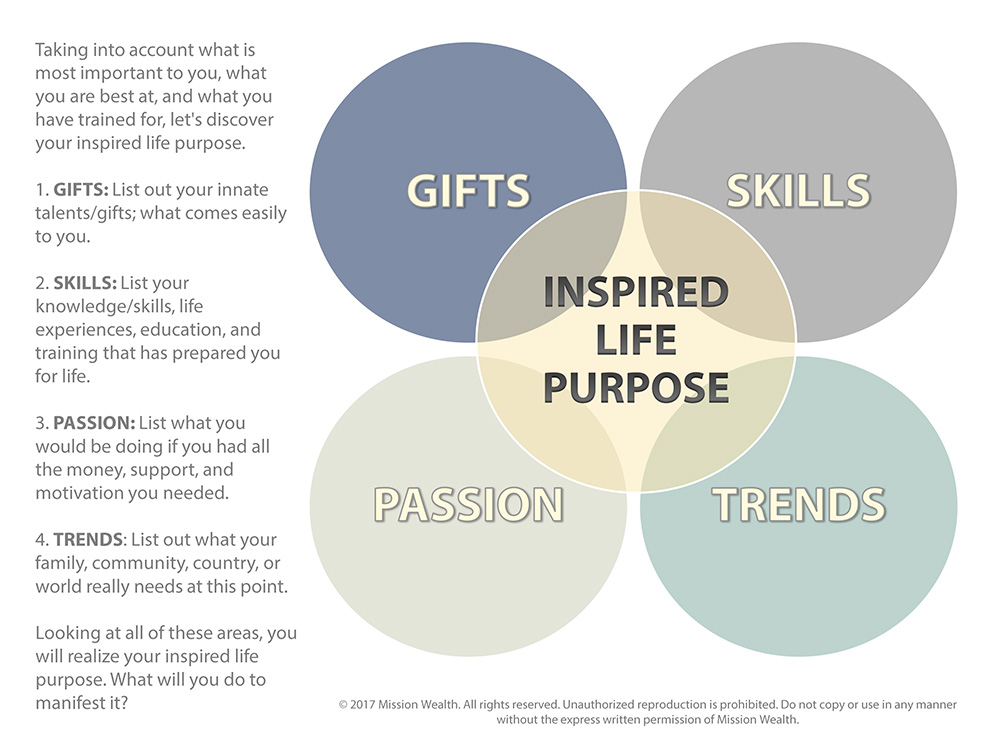

SS: It’s interesting; I’ve worked with a lot of executives over the years, and I’ve taken them through a process I call the Inspired Life Purpose Assessment (see graphic below). The best part is that when we have them look at the intersection of the four categories from the exercise—where their gifts intersect with their skills and education, what their greatest passion is and what they believe the world needs most—that intersection is their inspired life purpose. What’s really cool is that, instead of just thinking about return on money, its important for people to reflect on their return on purpose. What type of return are you getting on the purpose that’s within you that you really can’t deny? The one that has always been knocking on the door inside your soul. Return on purpose is an important dimension of wealth when we look at our Conscious Wealth assessment.

to learn more about creating conscious wealth and to take your inspired life assessment, visit: missionwealth.com/redefining-wealth

to learn more about creating conscious wealth and to take your inspired life assessment, visit: missionwealth.com/redefining-wealth

CLM: Return on purpose instead of return on investment. So, the more you align with your purpose, the more return you get?

SS: Absolutely. That’s been a truth I’ve seen over and over again. Back to those examples where people are taking the job out of college that they think will pay them the most rather than saying or thinking, “My biggest priority is to be in pursuit of my inner purpose. And I’m going to be in the fullest expression of my gifts, abilities, skills, and passion to try to push this purpose forward.” If those are the two things that they focus on, I can tell you they will achieve tremendous success and tremendous wealth in the ways that matter most to them.

CLM: That framework that you just outlined sounds like it’s a perfect way for people, if they’re not sure what their purpose is, to figure out where all these things overlap and to crystallize that for them.

SS: I would just encourage people to realize that you can be in expression of your purpose and be wealthy. I think a lot of people have this mindset that there’s two camps when it comes to money: There’s the capitalist who thinks greed is good, who’s just focused on money and has no life balance and maybe limited spiritual connection; and there’s the yogi who’s meditating on a mat and has their abundance board and their vision wall, and they’re praying to be able to pay their rent that month, but they don’t have a lot of financial abundance. It’s important to realize that you can have both; one is not in conflict with the other. The people that I’ve worked with who have become the wealthiest are those that have realized that there’s an absolute integration of those two. That you can be in full expression of yourself, connected to source, amplifying your gifts, being of service, coming from a place of joy while also kicking butt at a business, being paid a fair exchange for the goods or services that they’re providing to the world. Again, that’s what money is: money is just a reflection of energy, it’s a reflection of value. When you’re coming from an authentic place, putting out your best into the world with a purpose you care deeply about, there’s going to be value, there will be money.

CLM: I love this idea, especially with the new paradigm emerging from the way that society is restructuring itself with the Internet. It’s allowing people to earn money in ways that you’ve never been able to do before. You can have a knitting store selling little personalized mittens for children and be a millionaire! You have to start to rethink your life if you’ve been operating from the old paradigm where you just have to show up and get your paycheck. You really have to reconsider what your life purpose is because that’s going to be the key to your happiness and abundance and all those things that you’re talking about.

SS: Everything is available. People feel threatened by the changes that are happening now, where more and more jobs are going to be automated—whether it’s driverless cars or robotics or it’s artificial intelligence coming into our machines—the Internet of Everything; yet, I see it the opposite. I see it as such a tremendous opportunity for you to finally say what is uniquely you and ask how can you bring that into and a place that you really care about. And you guys are a great example of that by the way!

That’s why the best companies out there that are attracting Millennials are those that have a purpose and a mission to their company and people will work for those types of companies—with even a lower income level—because they are so behind what that company is about. And Millennials want to work for a company that they believe is doing something good for the world. It’s not just about a paycheck, and that’s been a shift.

photo: lerina winter

photo: lerina winter

Our parents’ generation would go where the jobs were. They would move the family, and they would make their life in Toledo, Ohio, if that’s where the job was. Millennials say: “Where do I want to live? How do I want to live? And, by the way, I will find a way to make my career blend into that lifestyle!”

CLM: You’ve intuitively pulled up the concept of Financial Evolution; it was kind of bouncing around in the background. What is Financial Evolution and how does that play into everything?

SS: As we’re talking about Conscious Wealth, I think there are additional trends that are supporting it besides what we spoke about before. Those trends include careers where people want to work for mission-led companies and be part of a culture that feels really aligned with them, and they‘ll make less money to work for a company like that.

When we take a look at investing, it used to be that people invested just for a return, and they wanted to maximize return. And, now, there’s over $20 trillion in socially responsible investments. People now are saying, “I want to invest according to my values. I don’t want to own tobacco companies if I’ve lost my mom to lung cancer. I don’t want to own a company that does animal testing.” Whatever someone’s values are, they can now invest according to those values. Companies are taking note, and now companies are really cleaning up their practices because they realize not only their investors but then also the consumers really care more about the products they are buying. They look at labels and they wonder is this an organic product or is this made chemical-free? Companies are waking up to a greater level of consciousness because of investment influences and consumer influences.

When we look at definitions of success, it used to be that material success was the greatest—the Porsche and the Ferrari and the boat and the mansion—that was how someone was successful. And, now, as we mentioned (and Millennials know) it’s about lifestyle—it’s about balance, it’s about time for health, it’s about purpose, it’s about giving back. Even in my career, in the financial services world, it used to be that advice was solely based on investment decisions, cash flow planning, taxes, estate planning, insurance. Now advisors are starting to measure these holistic metrics. They’re starting to talk about happiness and career alignment and return on purpose to actually measure what matters most to people. There’s a lot of wonderful trends that are also kind of shifting this greater consciousness around money and I call that the Financial Evolution.

CLM: So, here’s another kind of devil’s advocate question: Having been on both sides of the coin, where, at first, financing business was just this super-complex, obtuse thing; it seemed hard and expensive to play with and risky. But since I’ve erased that, I’ve really learned that it’s not that hard, it’s not that complicated; just some general ideas and principles that, once you understand those, things start to make sense. Taken out to a practical level—this might seem like a basic question for someone who is running a wealth management company—how can someone get started? Not everybody who’s reading the magazine is going to have millions of dollars. How can someone with $30,000 or $74,000 who wants to invest their money impactfully, how can they get started?

SS: It’s interesting that when I think of the 35-year-old who makes $70,000 a year, the level of attention that I will hear that they put into their diet, their workout regime, their travel, vacation planning, their social events that weekend, maybe even their wardrobe—they put a lot of thought into those areas. But when it comes to really building their personal wealth in the traditional financial sense, they put very little thought. Maybe they just invest in a 401K, and they just try to pay off credit cards and student loans and that’s all they really think of. We’re talking three minutes a week is all they spend thinking about this.

The first step is to have a dedicated practice to your wealth—the same way you have a dedicated practice to meditation or to your yoga practice. You have to have a dedicated practice in which you first sit and visualize what you want from your life—as far as lifestyle, as far as the types of investments you want to make, as far as the type of home you want to live in—you know, really visualize your life. Step two is making an honest assessment of where you are at today. Ask yourself: “Now that I know where I want to go, where am I today? How is my career tracking? Am I maximizing my career opportunities in my current role with my current company? How am I doing with my debts, with my savings, with my investments?” Once you then have that honest assessment, then the third step is to now develop a strategy forward. “What are the next steps that I can take?”

It comes down to kaizen: incremental small steps. First is, “I’m going to commit to spending less than I earn, so I have a surplus. I’m going to find a way to live within a certain budget and be mindful because paying myself first needs to be one of my most important bills.” Just as important as it is to pay your mortgage, you need to pay yourself first. Once you’ve committed to having that surplus to pay yourself first, then you ask: “How should I be investing this surplus?” However small it is, starting somewhere—it could be $50 a month—start there. You want to say, what’s the smartest ways I can invest? From a smart standpoint, tax-wise, you want to take advantage of pretax or tax-free type of growth vehicles. Maybe it’s your 401K with your employer; maybe it’s a SEP IRA if you’re self-employed; maybe it’s a Roth IRA; there are a lot of different tax structures that can benefit someone for long-term accumulation.

Now that you know how to invest in a smart fashion, you then ask: “Now what do I do as far as my investing within that vehicle? Within my Roth IRA or within my 401K, how can I invest that money?” That’s where you can seek professional guidance or do some research online to understand the power of compounding interest, the importance of asset allocation, the importance of rebalancing. Once you have that type of piece in place, then you can ask: “To what degree do I want to make this a socially responsible investment?” There’s mutual funds out there; there’s exchange-traded funds out there; there’s companies that can do screening on stocks and bonds for you to make that investment a socially impactful investment.

It comes down to simple steps; but it really begins with taking time to visualize, making it a priority, and then breaking it down into simple, action items the same way you would if you were trying to change your diet or begin a yoga practice.

CLM: So many people just ignore finances, especially conscious people because money has got so much stigma around it. Without guidance, without having gone to school for it, it could be a little intimidating. It’s pretty straightforward; if things get complicated, then you can just go with a financial advisor.

SS: There are also a lot of online robo-advisors available today. You could do this all from the comforts of your home and be able to have professionally managed money much cheaper than ever before. There’s really no excuse; it can be done—with a few clicks of a button, you can have a portfolio. The thing that I would encourage people to think about is not just their financial assets but that we all have a lot of forms of assets. What is your artistic capital? Maybe you have a lot of creative genius that isn’t being fully deployed with your current employer. Or, maybe you have good social capital: you have some really fantastic relationships and connections that you aren’t fully leveraging right now. Intellectual capital: what’s something that you have knowledge of or unique insight into that maybe isn’t being brought into the marketplace today? So, when you’re thinking about your assets, it’s not just how much cash and debt do I have today? It’s what are your unique assets that can be leveraged to help build more value and more financial wealth in your life?

CLM: To make this as practical as possible, let’s say someone’s in their 30s, somewhere in the middle of their life, and they’re wanting to be as successful as possible but still have fun, still honor their life purpose and have a meaningful life. What advice do you have for them?

SS: It may sound counterintuitive, but I would say they should be a lot more playful; they should have a lot more fun and have a lot more levity in their approach to life. I know that I always felt that to be successful in my career, I had to be super serious because money is a serious thing! Same with my workouts: I had to train to do an Ironman, and I’d be really serious about that. In my relationships: I want to be a really good parent. In a lot of different dimensions I’d realize this is really serious; I had a lot of responsibility in me. At some point, I realized that Buddhas are playful, and some of the most successful people out there have a kind of a gleam in their eye and a certain sense of playfulness. So, to that person I would say to think about ways in which you could have more ease, more relaxation, more playfulness. When you’re at work, smile more; I think you’ll find that you’ll actually do better. It sounds kind of counterintuitive, but those people who have a lightness about them, it brings a certain confidence, it makes you more approachable, it makes you more likable; you’re going to be more promotable if you have more playfulness and ease in your every day. You don’t have to prove anything to anyone. Just be light. Be yourself and allow your natural abilities to flow into your career. I’d say that’s the most important advice: have more ease, more joy.

CLM: Do you have any final thoughts that you’d like to share?

SS: I’d say that my passion is being a positive catalyst in people’s lives. Anyone in professional services has this ability to be almost a Trojan horse, to show up and have the other person think we’re talking about a tax return or a portfolio, but really we’re here to be a change agent in someone’s life for the positive. That is really helping my business grow exponentially across the country. You can really have the same thing. Figure out what your deepest purpose is; be bold enough to pursue that. Understand that vulnerability is strength; it’s not weakness. The more vulnerable you are, the more people are going to feel they can relate to you, and they’re going to feel like you are being truly honest and genuine with them. It’s going to serve you in your career and in your relationships. Be able to really define what wealth means to you. My experience with hundreds of families has been that wealth is not external; it’s really about internal work. Wealth is about knowing your priorities and living them. It’s about a lot more than just money and encompasses those other nine dimensions of wealth. It’s about being of service to others—the more you give the more you get—and that’s the truth. It’s about meaning; making sure you have meaning and connection every day with others and with strangers. It’s about appreciating what you have and it’s about wanting less than you have. As long as you want less than you have, by definition, you are already wealthy. Be bold enough to redefine what wealth means to you and just lean into that and watch the abundance flow your way.

About The Interviewee

Seth Streeter Seth Streeter is the Co-Founder and Chief Impact Officer of Mission Wealth, a nationally recognized and employee-owned wealth management company that empowers families to achieve their dreams. Mission Wealth manages $5 billion in assets for over 2100 families and non-profit organizations.

Headquartered in Santa Barbara, CA and Austin, TX, the firm has offices located across the country. Mission Wealth is proud of its recent Best Work Places recognition by Fortune, Investment News and Inc. Magazine and as the #1 ranked Best Places to Work for Financial Advisers for firms in its size category.

Seth is a thought-leader in the area of conscious financial planning. He helps people reframe their perspective of wealth beyond the financial to enjoy more balanced, impactful, and fulfilling lives. In 2015 he was recognized by Real Leaders magazine as one of the Top 100 visionary leaders. In 2016 he spoke on the TEDX stage, The Untethered Life: Wealth Redefined and shared his powerful message. Since this time, he has been an in demand podcast guest on numerous industry shows; including, Fidelity Fin Point, ForbesBooks, Belay Advisor and Becoming Referable. For more information and resources, visit: missionwealth.com/redefining-wealth